Life Insurance in and around Omaha

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Omaha

- Douglas County

- Sarpy County

- Omaha Metro

- West Omaha

- Nebraska

Your Life Insurance Search Is Over

No one likes to contemplate death. But taking the time now to arrange a life insurance policy with State Farm is a way to show care to the ones you hold dear if the worst happens.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

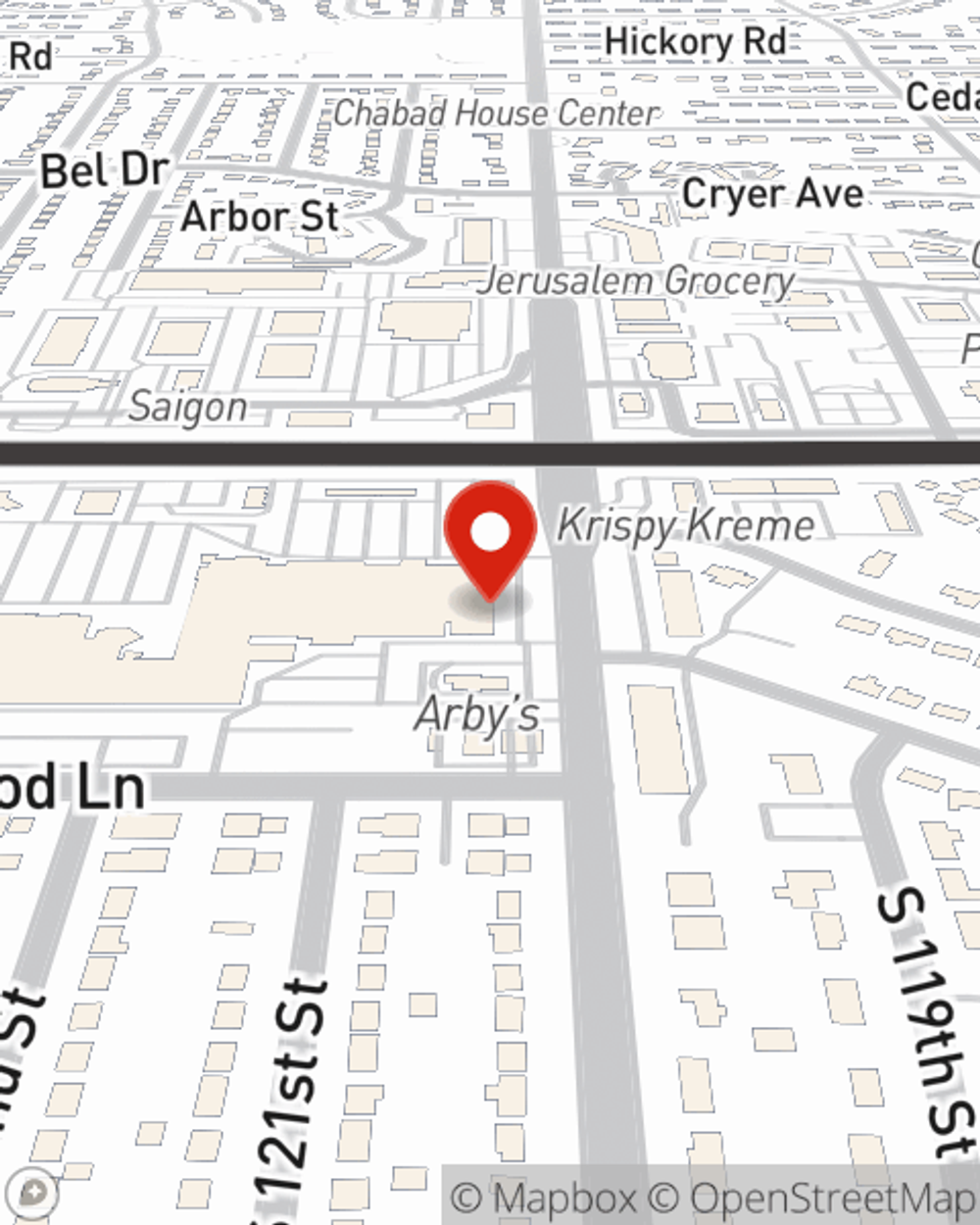

Agent Araf Evans, At Your Service

The beneficiary designated in your Life insurance policy can help cover bills and other expenses for your loved ones when you pass. The death benefit can help with things such as medical expenses, college tuition or utility bills. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, dependable service.

If you're looking for reliable coverage and compassionate service, you're in the right place. Call or email State Farm agent Araf Evans today to find out which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Araf at (402) 884-1885 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.